- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Bokföra egen insättning

Hello,

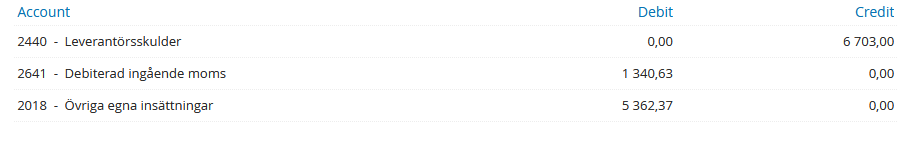

I have a related problem to what OP has described. I have done a purchase using money from my private account, and posted it to the ledger as

Account Debit Credit

|

2440 - Leverantörsskulder

|

0 |

6 703,00

|

|

2641 - Debiterad ingående moms

|

1 340,63

|

0 |

|

2018 - Övriga egna insättningar

|

5 362,37

|

0 |

5362,37 sek were not deducted from the profits. So I followed OP tip and added to the ledger:

but, still, the 5362,37 sek were not deducted from the profits. Do you have tips on how to correctly register the purchase, being it a purchase finalized to my business?

EDIT: Efirma, Visma eEkonomi Smart

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi!

I made an own thread from your comment on Bokföra egen insättning i en enskild firma. I understand that you followed the examples from that thread but the two examples that i gave there are two seperate examples and from what i can see you combined them so of course i will help you solve this. 🙂

Just so it´s clear, in the thread Bokföra egen insättning i en enskild firma the first example is if you have transferred your private money to the company account in your individual company and the second example is if you have made a purchase to the company but happened to pay with your private money. The examples are thus two different ways of accounting, in two different situations.

Back to your question:

The reason you 5362,37 sek were not deducted from the profits is that you haven´t booked any amount on a purchasing account. You used the right VAT-account so thats good but there is no purcshase to the VAT posted. In my example in the thread above I used the acount 4000 - Inköp av varor från Sverige to book the puschase, also the amount that is booked on account 2018 should be the full amout that you paid (6703). This needs to be corrected and i will show you how but i first need to know how the first post was created? Did you do it as a Supplier invoice under Purchasing - Purchase invoices in eEkonomi or did you do it manually under Accounting - Journal entries?

The second post, how did you create that one in the program? because you paid with private money and account 1930 affects your business account this post should be corrected as well.

Feel free to come back with answers to my questions above and I will look at it one more time. 🙂

/My

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi, and thank you for your answer!

So, I created the first as a Supplier Invoice, while the second as a new journal entry.

I reattach the screenshot of the Invoice for reference. Looking forward to hear your tips to solve the above!

The second entry I created as a direct journal entry. I guess it must be corrected as well!

EDIT 1: Wrong screenshot

EDIT 2: Regarding the second entry

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi,

Okay, well I think the absolute easiest thing is if you correct all bookings and redo it from the beginning. 🙂

Supplier Invoice

I suppose that the supplier invoice is marked as unpaid still.Go to Purchasing - Purchase invoices - click on the invoice that is incorrect - Actions - Void invoice. When you do this, a credit invoice is automatically created which the debit invoice is set off against and the accounting is zeroed.

Manually created journal entry

Here you create an exactly the same verification but vice versa in debit /credit. The same date and the same accounts as ordinary verification.

Now the bookings you have created should be zeroed in the accounting. However, it can be good to check the book balances on each account. You do this by going to Accounting - Account analysis and search the respective account to check that the posted balance is correct.

So, now you can post the correct post. In the program eEkonomi that you use you can handle this in different ways so I want to make sure that you received a supplier invoice for your purchase? Or did you pay for a purchase privately and received a receipt?

/My

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi My,

thank you for your answer, I think it clarifies a lot about the procedure. I can confirm that is indeed the case that I received a purchase invoice addressed to my efirma, complete with the VAT number and corporation identity number. I then paid it with my personal account, and wanted to register so.

I then imported with Visma the pdf regarding the invoice, and proceeded to register it as a purchase invoice paid from my private account (2018); then I created a manual entry as described in my previous posts.

Let me relist the passages as I happen to understand them:

-) Void the invoice

-) Register a reverse entry in the Journal to cancel the previous

Then proceed to recreate the invoice from scratch. Is that correct?

Again thank you for your help

/Antonio