- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

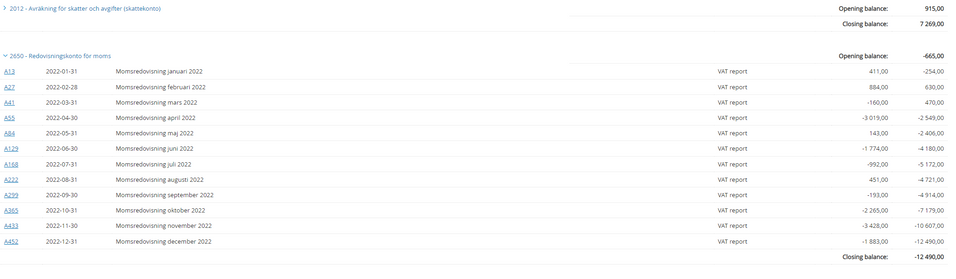

Enskild firma 2650 & 2012

Hello, I have a small side business. I've ran it from 2021.

Now its time to do my yearly declaration for 2022 but Im worried I have done something wrong as I have a large minus in 2650. When I pay Moms or get money back, I put it into 2012. Visma does my Moms reports and adds them into 2650. Here is how things look: (2012 : closing +7269, 2650: closing -12490)

So Im wondering, Do I need to zero the accounts before I do my declaration or do I zero them against each other in 230101? Thanks for the help!

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

When you send the VAT declaration to Skatteverket you should transfer the amount from 2650 to 2012. At the end of the year, only the 2650 amounts for November and December are not filed and should remain as a credit balance in 2650.

Your opening balance from 2021 and monthly amounts for January to October should be transferred to 2012 if they have all been declared.

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Thanks for the response, So in my case when I have been paying monthly, should I create a manual entry(for 221231) to transfer the amount in 2650 up to November to 2012 ?

Side question: I had been under the impression that as an enskild firma you do not need to book the tax account. So if I was to finish my bokslut as it currently is, would it be incorrect ?

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Ideally, you should post the VAT declarations each time you file them. But for now you can create a manual entry 221231 for all the amounts (separate items in the same manual verification) except for November and December.

And you are correct about the tax account not needing to be posted in an EF but you have to post the VAT filings. Since 2012 is an equity account, you could also use 2013/2018 if you prefer that. Leaving the VAT liability as it is would be incorrect since you don't owe the amount to Skatteverket any more.