- Prenumerera på RSS-flöde

- Markera inlägget som nytt

- Markera ämnet som läst

- Pinna detta Inlägg för min användare

- Bokmärke

- Prenumerera

- Inaktivera

- Utskriftsvänlig sida

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

One stop Shop från 1 juli 2021

Hello,

I hope it's OK that I post in English. My Swedish is still far from great.

My company is registered in Sweden and sells goods to private individuals in other EU countries. So far, I have been charging individuals the standard Swedish 25% VAT. On July 1, this will no longer be possible because the One Stop Shop is mandatory. I use Visma eEkonomi Smart.

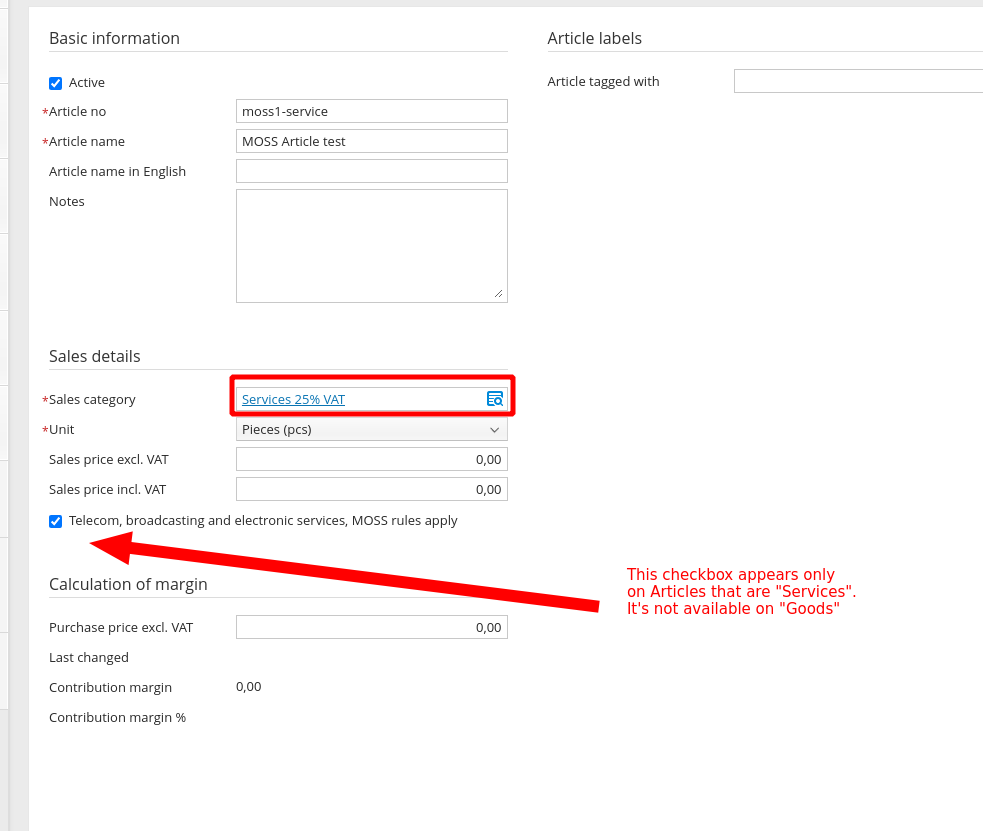

I see that eEkonomi Smart has functionality for MOSS but not for OSS. As far as I can tell, these two schemes are similar but not the same. MOSS applies only to services, not goods.

I tried enabling MOSS in the settings, and see that VAT rules have changed only for services. Goods are still charged at 25% VAT for all countries, like before.

What can I do to comply with the new regulations and continue using eEkonomi Smart?

Thank you for any advice!

Löst! Gå till lösning.

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi @nataliawi ,

You can continue using Visma eEkonomi Smart in the way you have done (MOSS), we are working on the functionality for OSS, so hopefully it will be available at 1st July.

I will give you an update on this page when I know more about it 🙂

Best Regards, Amanda

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hey Amanda,

thanks for a quick reply.

I'm happy to hear that Visma eEkonomi will have OSS functionality.

On July 1 I must start charging customers different VAT amounts depending on country. This is concerning to me because that deadline is approaching quickly.

As far as I can see, it's not possible to use MOSS functionality for goods. it's only available for services. Is there any workaround I can use to apply MOSS rules to goods?

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi!

When I look at the Swedish Tax Agency's page MOSS – redovisning av moms på digitala tjänster, abosut MOSS it is services this is applied to. They write more precisely "When you sell certain digital services, you must charge VAT according to the rules that apply in the country where the buyer is located. To make it easier for you to report VAT for such sales, there is the Mini One Stop Shop (MOSS) service. ". Thats why you cant choose this setting on your goods today. But from 1 July 2021, new rules will be introduced which mean that more companies that sell goods and services to non-taxable persons, such as private individuals, may be required to register for VAT in the buyer's country. The former e-service MOSS is then being replaced wich is mention above and as my colleague Amanda said we are working on the functionality for OSS. We will updete here further when we know more.

Have a great day! 🙂

/My

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hey Amanda,

can you give us a status update on the One Stop Shop (OSS) support in Visma eEkonomi Smart?

The OSS rules come into effect on July 1, less than a week from now. Our company sells goods to individuals in other EU countries, and therefore we are required to follow the OSS rules.

If the OSS is not supported in Visma eEkonomi Smart, then please suggest a workaround or advise if we should switch to a different software product.

Thank you

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi Nataliawi!

From the 1st of July Visma eEkonomi will have the support necessary to follow the new OSS rules. Nothing is required for you to do as a user in order to have this in your program, it will be available on the 1st of July when the new rules come into effect.

The only thing we will not support directly on the 1st of July is management and follow-up of the turnover threshold in the program. More information will come regarding this in future so we will keep this thread updated once we have new information to share regarding this.

Hope this was helpful. Please reach out again if you have any further questions.

Have a lovely day!

/Agnes

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Will there be information on how to handle this in your system as well?

Would have loved to at least see how it looks to be ready for the adaption when it is here.

Planning to work with it from start as I've already gained access to the OSS portal.

//Ole Sollie

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi!

There will be a ready-made setting for OSS, this setting means that no manual imposition from you is needed if the setting is set. More information about how this setting will work in the program will be released soon here in our forum. A tip is to have a look in the Visma eEkonomi Nyheter tab in our forum where the information will be released. You can also subscribe to the tab by clicking on the three dots and click on Prenumerera, if you do you will receive an email when news for Visma eEkonomi is released.

Have a nice day!

/My

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Follow-up question.

For a webshop using a 3:rd party payment service like Klarna/PayPal.

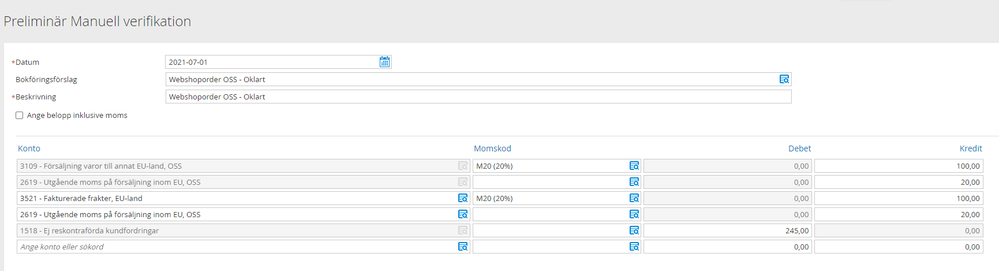

Would the Verification example per order be like this?

3109 - Försäljning varor till annat EU-land, OSS | M20 (20%) | Kredit 100

2619 - Utgående moms på försäljning inom EU, OSS | empty | Kredit 20

I noticed that the Code FR-S (france standard 20%) as a test and it did not automatically add a VAT field So I added this myself and calculated the 20%.

Then also wondering about invoiced freight cost, should this also get the local tax for the purchase?

Could probably just bake together these posts then for the "sale" as whole?

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi!

We've looked into this a bit and you need a code at 2619 as well. See example in picture below:

Regarding the freight cost - we haven't been able to find information about this. I recommend that you check this with an accounting consultant.

Best regards,

Moa

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Your image did not work but I assume that you mean the VAT code that basically mirrors the one I chose for the row of the sale!

Thanks for the info, then I believe I might be ready!

Friendly regards,

Ole

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi

Will there be a button I need to click on the 1st of July to activate OSS, like the MOSS button ?

//Henke

Produkter & tjänster

Utbildningar

Visma Spcs

Copyright 2025 Visma Spcs. All rights reserved.